Live Nation’s Michael Rapino Named Most Impactful Executive of 2019: The Pollstar Interview

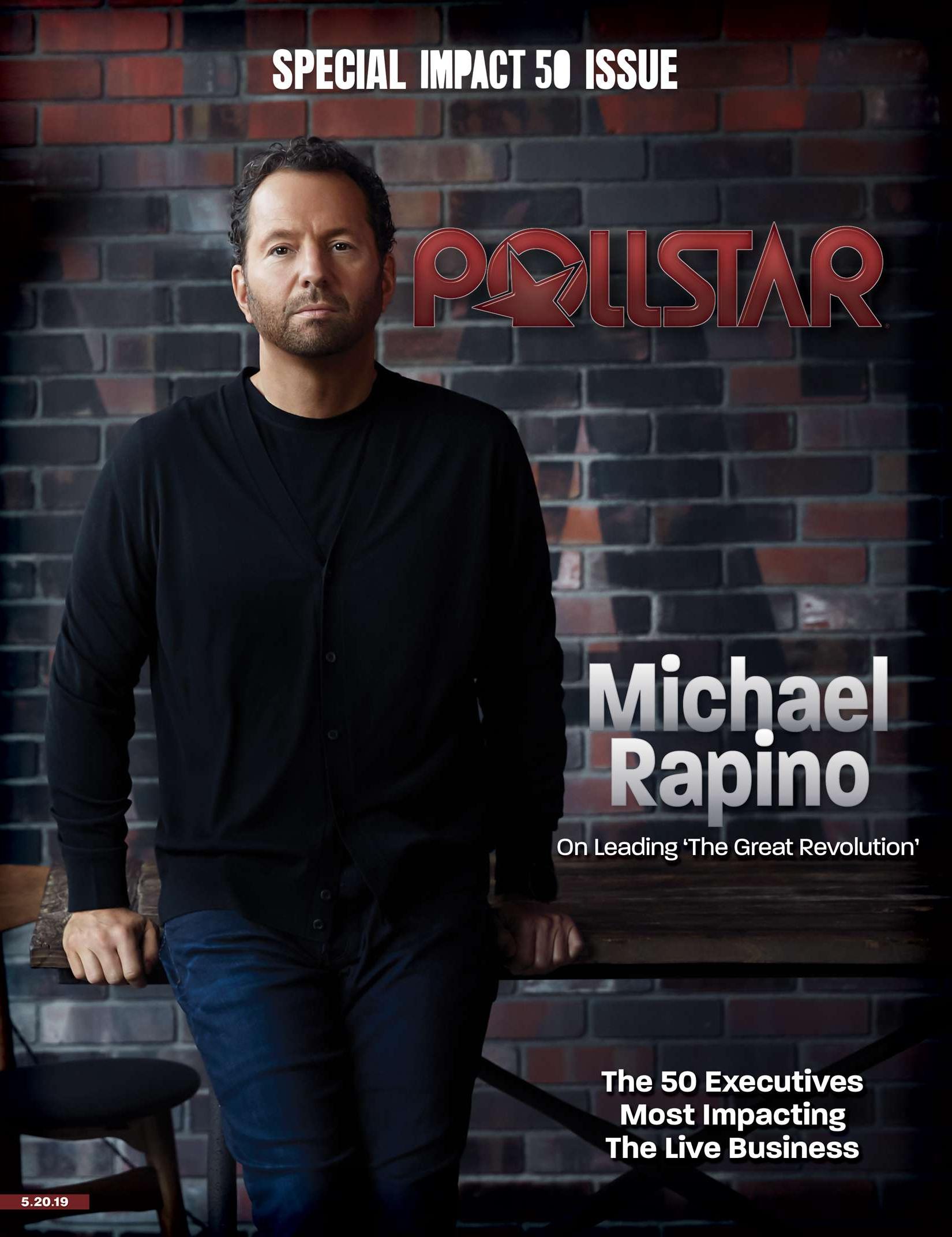

Coral von Zumwalt / Courtesy Live Nation – Michael Rapino

photographed at Live Nation’s Beverly Hills Offices

Pollstar’s Impact 50 differs from other industry lists in that, rather than merely attempting to rank or quantify certain achievements, status, influence or financial metrics (all of which are considered), we set out to acknowledge individuals who will most impact the live entertainment industry in the coming year. While this list doesn’t rank individuals, certainly Michael Rapino, President and CEO of Live Nation Entertainment, would be at the top of any list of executives who impact not only the live music business, but the music business, period, and the entertainment business at large.

Rapino, 53, has steered Live Nation for nearly 15 years, overseeing the world’s largest promoter (Live Nation) and largest ticketing company (Ticketmaster), as well as its biggest management company (Artist Nation), with some 500 artist affiliations. His impact is both internal, running a company that employs 38,500 people in 40 countries, and external, as Live Nation and its affiliates promoted or produced 35,000 shows in 2018 that drew 93 million fans.

Once trailing rival AEG Presents in the U.S. festival game (though Live Nation has always been dominant in Euro fests), Live Nation now owns or partners with about 100 festivals globally. It’s also among the world’s leading venue operators, with more than 220 clubs, theaters and amphitheaters globally. Live Nation’s branding and sponsorships division boasts more than 1,000 brand partnerships, spanning naming rights, multitiered tour sponsorships and everything in between.

Following the turbulent years that began with Robert Sillerman’s furious promoter rollup and culminated in SFX Entertainment’s acquisition by the Clear Channel media conglomerate in 2000, Rapino ascended to Live Nation’s helm in 2005, receiving what amounted to a battlefield promotion after he “made his bones” organizing and synergizing the disparate European promoters acquired under SFX. In the face of a dubious industry and distrustful concertgoers, Rapino quickly steered the move to spin off from Clear Channel and take Live Nation public in 2005. He has since withstood intense Department of Justice scrutiny, internal shakeups and the biggest economic downturn the modern concert industry has ever faced.

Under his leadership, Live Nation orchestrated a merger with Ticketmaster (2009) and made some 50 (and counting) strategic acquisitions. The company also moved toward decentralization that empowers regional and local promoters, fosters continual innovation and technological advancement from Ticketmaster and built powerful branding, management and sponsorship divisions. Live Nation Entertainment now leads an industry that has enjoyed unprecedented levels for nearly a decade – all under Wall Street’s watchful eye as live music’s only public company. Put simply, Rapino and his team have completely blown up the paradigm of a touring industry built by risk-taking entrepreneurs overseeing regional fiefdoms in the age of arena rock.

In person, the native of Thunder Bay, Ontario, eschews the traditional buttoned-down CEO stereotype for hip casual and – aside from the clear respect his presence generates in a room – could pass as any of the generally younger staffers milling around Live Nation’s Beverly Hills office. The vibe in the reception area (think Starbucks meets House of Blues) is upbeat, fun and purposeful, and Live Nation is very much on a roll. After a record 2018, revenue was up 17% in Q1 to $1.7 billion, with a record Adjusted Operating Income of $115 million on a path to what they believe will be double-digit AOI growth for the year. Fifteen million fans attended Live Nation concerts in the first three months of 2019, up 12% year-over-year. Already, nearly 50 million tickets have been sold for Live Nation shows in 2019, up 5%. Rapino expects all divisions to be up double-digits in Q2.

In less than 15 years, Rapino has rocketed from a relative concert industry unknown to the innovative leader of the most powerful live entertainment company ever, a company he believes has plenty of runway for global growth. He is Pollstar’s Most Impactful Executive of 2019.

Coral von Zumwalt – Michael Rapino

Pollstar: Before you became CEO it seemed there was little direction other than growth. Talk about how the job has evolved since you became CEO.

Michael Rapino: The good news is our story is fairly consistent in that we saw [the promise of] “live” early on. Because I was in London during the Clear Channel days, and then we spun it out here to Live Nation, for me from the start it needed to be a global business. When you look at what we’ve been doing for the last 10, 12, 13 years, what I still do today is make this a global business.

The numbers have changed: We’re now at 30,000 shows [annually] in 42 countries. When I officially took over the inherited Clear Channel Entertainment, we were in seven countries, with some 6,000 events, but our goal was always the same.

This was when the artist was just being “unlocked” by the internet and becoming global. Now that artist can sell out stadiums in Milan or Cape Town and we needed to build a global business to service them. That’s been our consistent strategy then, today and still. As big as we are, we’re only a 30% market share of the global business. You’ll be hearing me talk about this global story and our pursuit of growing globally for the next five, six, seven years.

Your 2018 was impressive, with revenue up 11% and profit at $60 million, up from a net loss in ‘17. Even so, when you look at a company of this scope, there are probably easier ways to earn $60 million?

Our business is about revenue and EBITDA [earnings before interest, tax, depreciation and amortization], so if you look in 2018 our EBITDA reported was $829 million. When we took this company over, we made $40 million EBITDA. Our job has been to grow global business from revenue, ticket sales, and sponsorship and then turn that into EBITDA. The net income is a result of investing. If we didn’t invest, we could spit out a higher net income, but we believe that investing our own dollars and building our platform out, whether it’s building organically our Ticketmaster skill set which is fixed cost and variable cost, and cap X, or whether it’s building by acquiring people to build. That’s why the $800 million turns into $60 million. We’re spending that money. That is why our business has been growing and our stock prices ultimately increased, because we’re better off using those dollars and reinvesting in the business to build a bigger and better longterm business.

Christopher Polk / Getty Images – Michael Rapino and Rihanna,

who is managed by Live Nation partner Roc Nation, pictured here at the 2nd Annual Diamond Ball hosted by Rihanna and The Clara Lionel Foundation in 2015 in Santa Monica, Calif.

A recent Pollstar article quoted Liberty Media’s John Malone saying, in effect, “a CEO should forget about earnings, and instead focus on appreciating assets.” How true is that?

We’ve been doing both. We believe building a global business and being the market leader and having the best businesses, ultimately, is why this business will continually increase in stock value and overall valuation. We’re making money, as you can see, $800 million-plus dollars in EBITDA off of our revenue. This isn’t Uber, this isn’t Lyft; this is a cash-positive business on a very low-margin basis. We’ve been doing a fabulous job of finding the fine balance between growing top line and producing consistent cash flow and reinvesting in the business. All those other companies going public are borrowing debt or raising capital to fund their losses.

Concert attendance has gone up several years in a row and it’s at sniffing distance of 100 million, which certainly helps on the cash flow side. How do you keep the concert attendance train rolling with only so many days in a year and artists who can play?Global. This is a business you and I have been in for a long time, but it’s a U.S./Western Europe business, where there were stadiums and arenas. But now, with the “unlock,” Billie Eilish is as big in Colombia as she is in Cincinnati, so the ability to tour around the world, as with any artist, has just exploded in the last five or six years. You’re going to see the pie grow because there’ll be more shows and more cities to support these shows. Now every major city in the world wants to be a great arts and entertainment capital, and they’re building new arenas and stadiums. They have suites, legitimate sponsors and ticketing systems. Asia, Eastern Europe, India, Africa, Latin America are all now legitimate markets.

But do we have enough artists and artist development to feed these markets with viable talent?

You look at it in terms of supply and demand. Demand is greater than ever. For any business, that’s a good thing. Thankfully, in Milan, Dubai, Cape Town, there’s a 19-year-old saying, “I want to go see Billie Eilish,” and that didn’t exist before. So you have a global marketplace now that says, “I want to be part of this live experience in a great venue or a great festival.”

Most industries would pray their business was lit up by a global demand that you don’t even have to advertise to, they wanna do it.

So what’s the supply side? Again, you look at the data. Whether it’s people playing guitar, local clubs, the explosion of small clubs across America, more bands playing in more clubs today or more artists on the road. So all the data would say there’s new Billie Eilishes coming up every day.

Who’s doing the A&R now? Is it the agents? Or you guys? Many would say it’s not the labels at the level they once were.

The gatekeepers are different now and there’s more ways to get traction. So how do you find this talent? Online, your local club, YouTube or SoundCloud – the good stuff percolates to the top and they instantly perform for their own little independent audience. They get that one song and 25,000 kids can listen to it.

It’s self-perpetuating to a degree.

It does seem that way. It might be a mile wide and an inch deep right now, more talent and lots of songs posted on SoundCloud, lots of which never sees the light of day, but that’s provided a huge motivation to a young new DJ or artist that says, “I can do this. I can get in my room with a Mac computer and make some music and put it up on SoundCloud” – as Elon Musk did last week. I like having a wide gatekeeping system versus a small one and we’re seeing that more and more on a global basis.

A lot of the power is in the curation and who says, “check this out.” Is that where influencers play a role?

I don’t have the answer on how it gets from a wide platform to curation. We’re seeing it through Spotify and playlists and different ways curation is starting to come to life; but for us right now, I would just say I’m thrilled there’s a good supply/demand problem going on. So, if there’s more global artists putting their music out there, statistically we’ll keep punching through that 5% of superstars. That will happen and young artists, country artists, Latin artists and others will poke through and be discovered and they’ll all of a sudden have a touring business behind them.

I think we’re at the start of a great revolution where artists are unlocked, demand is wide and big for small to big experiences, and curation will be part of the next music product discovery development. So we’ll leave that for some of the distributors who are doing a good job to try to sort through that.

We’ve been writing for years about who’s gonna replace the acts who have sustained the business forever. Yet, here we are with the best numbers we’ve ever seen as an industry and it’s sorta taking care of itself.

I’ve been asked about this for probably 15 years. “Who’s gonna replace the Rolling Stones and the U2s?” I have three young boys. My 8-year-old and 6-year-old boys, they live on their iPad, they discover music way beyond what I was doing at eight. My kids can sing songs by U2, Imagine Dragons, they’ve just discovered them differently. They know Marshmello because of “Fortnite,” they know every Black Sabbath song because of “Iron Man.” By the way, they have played their own instruments and uploaded it on YouTube, even though we keep it private so no one can really see it. Hey, for an 8- and a 6-year-old to play music and upload it, that’s great. Statistically, it’ll go nowhere, but when we were six or eight, we didn’t have those opportunities. It was a very narrow pinhole you had to find to become a rock star or successful.

So now that the gate is opened up wider, there is a lot of junk that gets through the gate, but I’ll take the volume going through the gate as a better indication of the future. I’m not worried that great will always rise to the top and find an audience.

I was looking at Ticketmaster’s sales being up 14% to [AOI] $436 million. That speaks to people going to events, congregating and going to shows of whatever type.

In 2018, Ticketmaster was 40 years old and had its record year, the largest sales ever in 2018, and this is a brand that many thought its best years were behind it. I think that shows you what a great job the team has done at Ticketmaster, rebuilding and making Ticketmaster relevant in 2018, but also the vibrancy and robustness of the live business.

Sponsorship is also up 14% to half a billion dollars, which speaks to the product you have to attach sponsors to, which is live.

One of the things we’ve done well, going back 10, 15 years is continually upgrading that division. Now, when you have 98 million people going to your shows, larger than Major League Baseball or any other league, you have a real legitimate audience for a brand. Now being part of live music isn’t a risky option anymore. We can deliver you a real measured CPM against a real targeted audience. Where the wind is at our backs is, as a brand, you may not be sure how to sort through all the digital businesses and how much you’re really affecting people when they see your ad on Facebook, so they’re all looking at part of their budget and saying, “I want to make sure I know how to talk to Ray onsite and directly as part of my budget.” So they shifted a lot of those dollars into event marketing or onsite or ways we can walk in and say, “Listen, we can deliver you a 19-34 or 35-46 [demographic], you name the segment, we know where they’re gonna be on a Thursday. We can deliver a very targeted audience for you at scale across America or across the globe, with your message.”

We would be the largest entertainment agency in the business if you stripped it out on its own. It’s a legitimate business that has to deal with CMOs, Madison Avenue, top brands, and we have to compete for those dollars and to deliver. We have an incredibly high renewal rate.

The business overall has done a good job of not beating people over the head with sponsorships. In many cases, it enhances the value of the shows and often the consumer is in control if they want to participate.

We’ll build it right and delay sponsorship until it feels right. First and foremost, we work for the artist and the brand. We can’t compromise that for any dollar.

Is sponsorship integrated within corporate or is it decentralized like it is for the buyers?

Nothing is going to get done at Bonnaroo, Lollapalooza or Austin City Limits that the three Cs don’t agree is in line with their brand. We’re providing more sponsorship opportunities, a much bigger back end, but everything, just like Pasquale [Rotella] with EDC, or Denis [Desmond] and Melvin [Benn] with Festival Republic or Governors Ball, is decentralized. We never mandate anything that would, in their minds, compromise the experience.

It’s been a pleasant surprise to watch how Bonnaroo (acquired by Live Nation in 2015) has evolved, as it’s in my backyard and I’ve been to almost every one.

This is a big year for Bonnaroo and we’re back to having incredible [ticket] sales. We’re getting back to our roots.

In a smart way, though, because if you stuck to what it has always been, people my age don’t usually want to spend the night in a tent.

You’ve got to evolve it. Over the last couple years with the C3 team, it’s been about onsite, onsite, onsite. What is gonna happen at midnight? What unique festival collaborations, acoustic shows in the campgrounds, what is the experience onsite? It is true that, as much as the headliners make sense, we’ve gotta make sure there’s a balance between the future and the past. We’ve found that this year. If you compare Bonnaroo to Lollapalooza, Coachella, and Austin City Limits, the big ones, they’ll all say, “This is a different three-day experience. We become a city. We have the real bond onsite. It’s more rugged, but it’s part of what makes it memorable.” If we keep staying true to making the three-day camping festival investment right, we’ll keep that brand strong for a long time.

You were talking about putting money back into the company. I can see you’re getting into the fringes, whether it’s secondary and tertiary markets, or smaller promoters like Dan Steinberg’s Emporium and bringing them into the fold. What’s the strategy now, and does it extend beyond venues and promoters?

We’ve been consistent. We’re looking at A markets, B markets, C markets. We’re consistently looking at artists, promoters, venues and festivals. Going back to that wider 30% globally, there’s a long list of great promoters, festivals and venues across this globe we’re always looking at. We’ll continue to keep bolting those on if we think they’re the right businesses, whether it’s in America, Canada, Australia, Milan or Rock in Rio in Brazil.

At amphitheaters, what’s the strategy with concessions?

The biggest thing we did was just focus. We put [President, Venues] Tom See in charge of our venues as we historically outsourced hospitality. That wasn’t a promoter skill set, it was “fill the venue.” A few years ago, we started investing in our own food and beverage hospitality division, and when you do that it starts growing this business. In general, being better onsite is the goal. You go to our amphitheaters now, our wine, food and beverages have been upgraded. We’ve increased all of our washrooms and menu boards, we’ve gone digital. We’ve been doing upgrades because we now have a real team waking up saying, “How do I run a better experience onsite?”

– The Rock Star and the Pres:

Michael Rapino’s interview with Foo Fighters frontman Dave Grohl showcased the top exec’s fandom, smarts and passion for music and was a 2019 Pollstar Live! highlight.

How is the clubs and theaters business performing?

Booming! We had a great year in 2018, with [Clubs & Theates President] Ron Bension and [Live Nation UK/Ireland chief] Denis Desmond, who runs our lineup in the UK. We have 200-plus theaters and clubs under different brands from Fillmores to House of Blues to local brands. We had a record year in terms of number of shows, attendance and ticket sales. As you’ve seen in every city in our nightclubs, whether it’s the Palladium [in Los Angeles] or the smaller 500-seater, live music has become a stronger business again. We’ve been building, expanding that business and we think there’s great potential.

Can you strategically go to a developing artist and lay out a plan, move them up the venue chain in ways that regional promoters did in an earlier era? Do you take those kinds of plans to managers?

We really don’t. I’m more obsessed with knowing what we’re doing is right for the artist, whether it means playing festivals, amphitheaters or arenas; we’re artist-first in that regard. What I care about is, when you’re doing 8,000 club shows, you’ve got a great young organization. We have a great farm team of young, great promoters, marketing, digital people working every day running those businesses. They’re the ones on the ground, finding the young bands, becoming great young promoters apprenticing their trade in the clubs and being connected at the entry level and up.

More important for us is just having a great, dynamic emerging artists division, where we’re able to impact artists at the entry level, but also having thousands of employees who are getting the training and their teeth sharpened at that level, who can help us be a part of the future.

Anything to say about the management side in Artist Nation and Maverick and artist development?

I’d just say we like that division. I think we have 17 or 18 management companies that we’re invested in. We think it’s a great division to get closer to managers who will have a different view of the business today on becoming really central to the artists’ strategy. We think it’s smart to be close to the artist, the manager; we think it helps drive our overall business.

How would you describe your leadership style?

Depending what day … hour. I’m very passionate and hands-on. I’m very demanding, but I think my job is to carry the torch of focus. At the end of the day, what I think our strength is, is I’m available 24 hours a day to do what my mission is: solve any problems and help get the artist onstage and performing. Our 30,000 employees are here just to do that and sometimes they’re demanding. On a Saturday at whatever time, I’m available and I expect my staff to be available. So this mission’s deep to me. It’s what I love doing, from [working with legendary Canadian promoter] Michael Cohl originally onward, this is what I wanted to do in life and putting artists on stage and helping them achieve their mission is what we do.

What keeps you up at night?

PR. [Jokingly acknowledges Chief Communications Officer Carrie Davis.]

Well, I’ve always told Carrie, it may be the most challenging PR job in the business.

It is, given it’s a tough, global, central and decentralized combination of businesses. It’s not a job you can come into to control anything. I don’t reward control, so it’s harder. You’ve got to add value. A lot of corporate jobs are control, right? Telling people what they can and can’t do, and I don’t reward that, so that doesn’t really help. If she says, “I told all of Sweden what to do,” there’s no value in that. Some jobs, that’s great value. You spend all of your days focused on it.

It seems this is a great place to work, right? I mean, you can have dogs in the office.

Daily Pulse

Subscribe

Daily Pulse

Subscribe