A Helluva Year End: Talking Top Tours & Small Venues

Every year since 1987 around this time I have taken some sort of a stab at making sense of the year that was for the live entertainment industry. For many of those years, a big part of that process involved calling regional promoters from various markets so they could bitch at me, or to me, about things like high guarantees, less than tenable building or merch deals, taxes, or various other issues these risk-taking small businessmen encountered in their quest to bring live music to their markets.

Guys like Jack Boyle in Virginia and Florida, Louie Messina in Texas and the Southeast, Don Law in Boston, Ron Delsener in New York, Alex Cooley in Atlanta, Jimmy Koplik in Connecticut, John Scher in Jersey, Arny and Jerry in Chicago, Larry Magid in Philly, Barry Fey in Denver, Bill Graham in San Francisco and Brian Murphy in L.A., among others. I would include Don Fox in New Orleans in this group but he never would let me get him on the record. God bless Don Fox. Jesus just left Chicago.

Those numbers climbed steadily, often by leaps and bounds with better reporting being part of it, but none of these guys could have foreseen the supernova of the post-consolidation global concert industry. Where it once took a dozen calls to get a handle on the stadium/arena level concert climate, two or three can get it done now, and often they’re all like Fox: off the record. I remember total grosses cracking $1 billion for the first time, now one tour can top $1 billion— twice. Taylor. And, hey, lest we forget it, Coldplay has done it, too. Much should be made of the fact that since 2022(!), “Music of the Spheres” has grossed $1,522,708,583, 10 digits, moving 13,138,644 (an all-time record for one tour) from 223 shows reported to Pollstar.

Back to the year that was. I don’t want to sound like that old guy, but I do have some perspective. Even in our world today, when some perceive flat as down, the global concert business remains robust, thriving and, with sports, the premier form of entertainment in the world, both in terms of value, or pricing, and willingness to pay a premium, or popularity.

OK, it’s not really flat. The total gross of the Top 100 Tours worldwide is $8.9 billion and 67 million tickets sold versus $9.5 billion and 70 million tickets sold, down 6.1% and 3.7%, respectively, last year. Given the ridiculous boom after two years of minimal (criminal) live entertainment, we’re actually back better than pre-COVID numbers, which at the time were unprecedented levels and in a 10-year growth spurt. So we’re experiencing a net gain commercially, without the insanity of being propped up by unnatural circumstances.

But the news is actually better than that. The totals are down, but the averages are up, which one could perceive to indicate better per-show performance and a healthy overall business. The Top 100 tours per-show average is $2.5 million and 19,000 tickets sold, versus $2.3 million and 17,000 tickets sold on average, respectively, in 2024. That means the new normal is nearly double what the industry saw in 2019, which came in at $1.3 million average gross and average ticket sales of 13,397. My takeaway is more acts are doing elite business on a consistent basis.

And it appears that North America’s loss in volume of shows could be the world’s gain. A top executive at Live Nation pointed out that overall consistency in venues and markets on a global basis is leading acts to devote more of their tours to international markets. Tours that might have played 40 North American dates in the past now might do 30 in North America and 10 international, he said.

Pollstar data backs up that position. The number of shows reported from international promoters climbed from to 24,383 in 2025, up 4.3% from 23,380 in 2024. Falling in line with that, international reports totaled $7.6 billion this year, up 8.64% from $7 billion in 2024. Ticket sales are also up 33%, to 90.1 million from 87.2 million. Some of this is no doubt due to better reporting from our international promoters and venues, something our team has worked hard to make happen for many years. But the dates have to actually happen to be reported.

So I can make this point: in 2025, for the global arena/stadium concert business, down is up.

But for some, down is down and flat is flat. Pollstar reported earlier this year that the market contracted for smaller venue categories, though mostly by single digits. This should not be news to anyone who paid attention to speakers on our State Of Independents panel at Pollstar Live!, or actually spoke to club promoters and talent buyers, or industry associations like National Independent Venue Association, National Independent Talent Organization and the International Entertainment Buyers Association, who have pounded the drum that the club sector is having a tough go of it. If acts are asking for the door, and “kids these days” don’t drink like they did, that’s bad calculus.

According to Pollstar reporting earlier this year, venues with capacities of 750 or lower sold an average of 278 tickets per show in Q3 2025, 3.5 percent less than last year’s 288 and 7 percent lower than 299 in 2023. The average ticket price was $34.74, up 11.1 percent over last year. Grosses increased 7.2 percent over 2024 to $10,075. Still, lower ticket sales means lower per caps for clubs who depend on ancillary sales.

For larger clubs with a capacity of 751-1,500, the ticket average dropped to 769 in 2025, a 3.9 percent drop from 2024’s 800 average and a more substantial 9.4 percent from 2023’s 849 average tickets sold. Average grosses YoY dropped 3.8 percent from $35,049 per show last year to $33,714 this year and saw a 6.1 percent drop from 2023’s $35,900 per show.

For venues in the 2,501-5,000 category, the change in average tickets sold between 2025 (2,629) and 2024 (2,661) is negligible, a 1.2 percent drop; the decrease since 2023 (2,894) represents a more substantial 9.2 percent difference. The same holds true for the average gross which remained on par between 2025 and 2024, but this year’s $169,980 average dropped 8.1 percent from 2023’s $184,947.

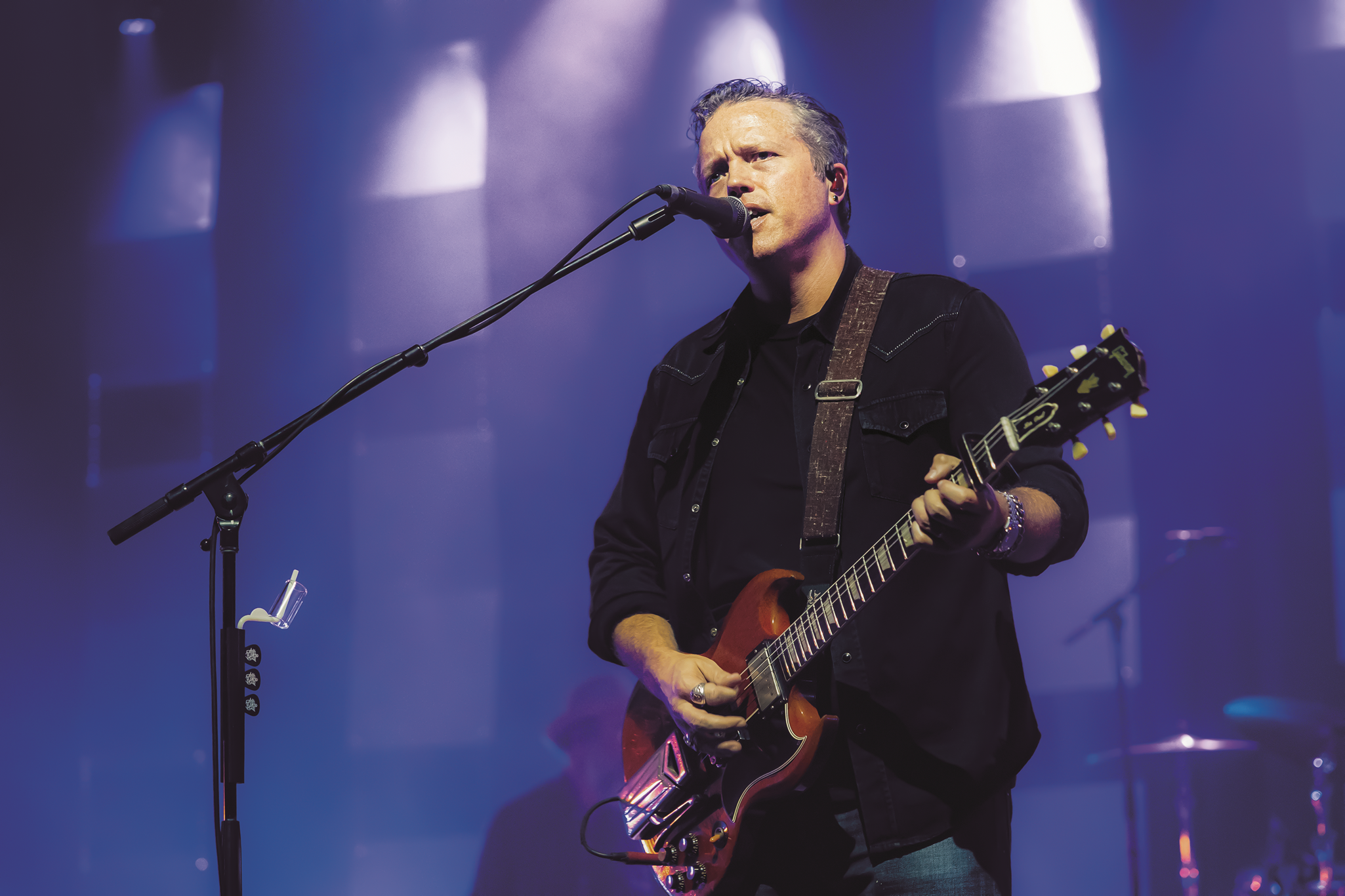

Venues of that 2,000-cap size is where singer/songwriter Jason Isbell and his 400 Unit largely make their living. When told that some smaller venues are experiencing softness, Isbell wasn’t surprised, adding that even on his near-sellout tour of 2025 he noticed some smaller markets where fans were seemingly “feeling the pinch.”

Part of the issue may be the number of bands out there actually able to play smaller venues because “the infrastructure isn’t there in the same way,” he said, noting the difference from when he first started touring as a member of Drive-By Truckers in the early 2000s. “It’s inarguable there were more avenues to make [a tour] happen, there were record stores where you could go sign, indie radio where you could do interviews, and legions of venues that went from 200 to 2,500 (capacity). There was a more defined path for going out and winning people over one person at a time. Now, it’s more of an all-or-nothing proposition.”

Any negativity found amidst these smaller, often independent, venues and buyers is bad, obviously. Like the people who attend our conference, the concert business ecosystem is not all Live Nation and AEG Presents. As a trade publication and a producer of conferences, we certainly depend on the support of these independents for subscriptions, registrations, box-office reports, and content. Report your box-office and we’ll tell your story. As for any empty seats, like Isbell said, “I always try to tell myself, don’t blame the people who showed up for the ones that didn’t. And that served us pretty well.”

WHO’S HAVING A MERRY CHRISTMAS

The top 10 of Pollstar’s Top 100 tours is an exercise in the broad tastes of what appeals to today’s concertgoer. I’m not going to call Beyoncé country, but I WILL call her a live entertainment juggernaut that can bring in over $407 million in a short year of touring. Look who follows: Oasis ($405 million), Coldplay ($390 million), Kendrick Lamar/SZA ($358 million), Shakira ($320 million), The Weeknd ($306 million), Chris Brown ($298 million), Imagine Dragons ($249 million), Lady Gaga ($208 million), and Post Malone ($197 million).

One can draw several conclusions from this list, not the least of which is that hip-hop/R&B is super healthy right now, as healthy as it has ever been. Rock shows up with Oasis and Imagine Dragons, and Metallica, Guns and Iron Maiden a bit further down the list, but would be nice to see more. And country—where’s country in the top 10? One has to go all the way down to 33 to find George Strait, the King for sure but hardly a developing artist. Morgan Wallen would certainly be there if he reported, and likely has the highest grossing country tour ever.

Daily Pulse

Subscribe

Daily Pulse

Subscribe