Features

Mixed Messages: DOJ Claims Live Nation ‘Repeatedly Violated’ Consent Decree, Then Extends It (Analysis)

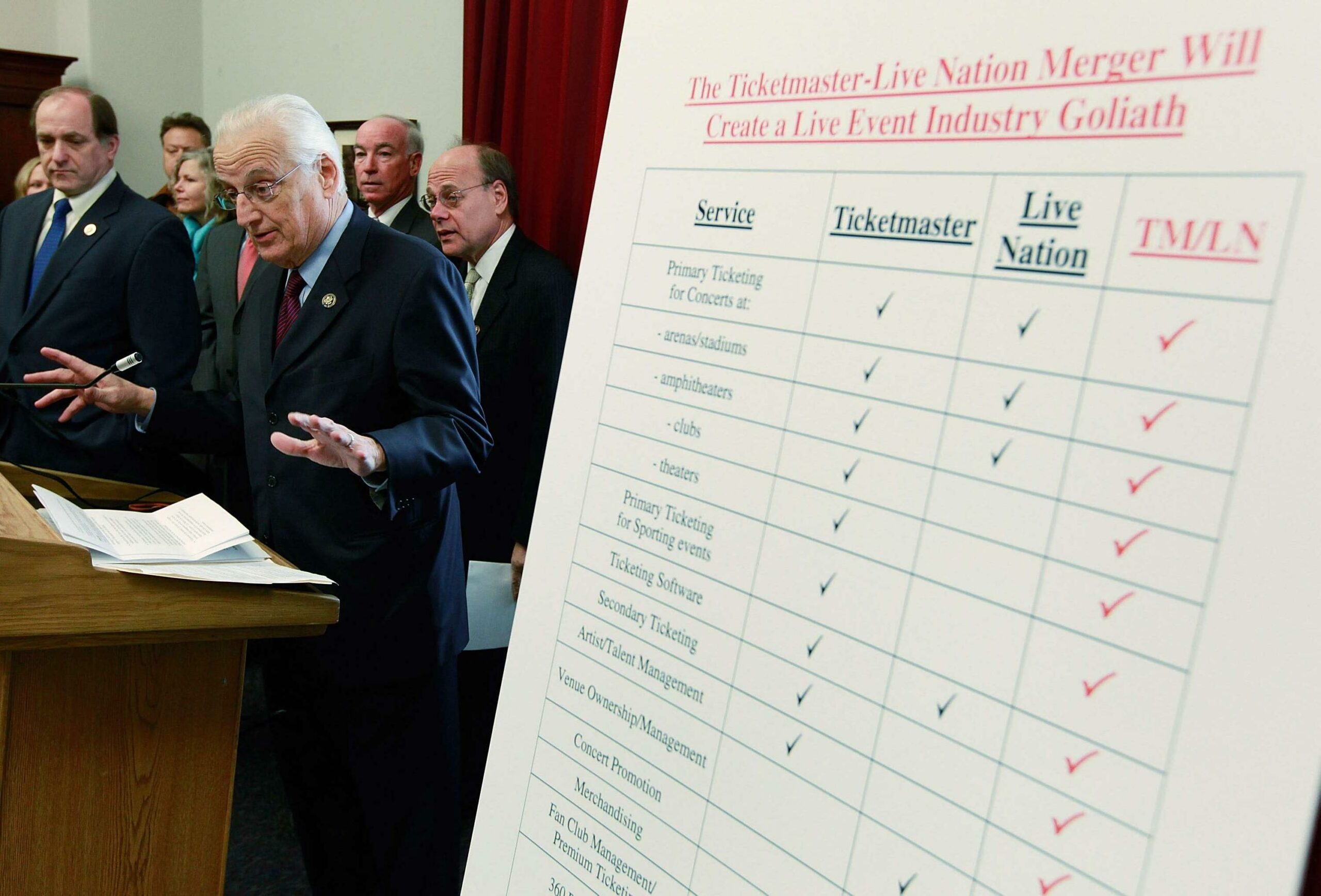

Mark Wilson/Getty Images – Merger

Rep. Bill Pascrell, Jr. (D-NJ) speaks about ticket prices during a news conference organized by opponents of the Live Nation / Ticketmaster merger on Capitol Hill in Washington, D.C., Dec. 16, 2009. The U.S. Department of Justice recently found that Live Nation and Ticketmaster had “repeatedly violated” the consent decree, but it nonetheless both the DOJ and Live Nation agreed to modify and extend it for five-and-a-half years.

The U.S. Department of Justice did not mince words in its Jan. 8 “Memorandum In Support Of Motion To Modify Final Judgment And Enter Amended Final Judgment” against the world’s largest promoter. Written by DOJ Antitrust lawyer Meagan K. Bellshaw, it stated: “The Defendant [Live Nation] failed to live up to their end of the bargain.”

Live Nation vigorously denied any wrongdoing, stating that it “settled this matter to make clear that it has no interest in threatening or retaliating against venues that consider or choose other ticketing companies. We strongly disagree with the DOJ’s allegations in the filing and the conclusions they seek to draw from six isolated episodes among some 5,000 ticketing deals negotiated during the life of the consent decree.”

The DOJ’s assertions in its official documents, that Live Nation “repeatedly and over the course of several years violated” the rules set forth in its 2010 consent decree that allowed the Ticketmaster–Live Nation merger to transpire, were unambiguous. The specific accusations stated that Live Nation was “retaliating against concert venues for using another ticketing company, or conditioning or threatening to condition Live Nation’s provision of concerts and other live events on a venue’s purchase of Ticketmaster’s ticketing service … Specifically, Defendants have repeatedly conditioned and threatened to condition Live Nation’s provision of live concerts on a venue’s purchase of Ticketmaster ticketing services, and they have retaliated against venues that opted to use competing ticketing services – all in violation of the plain language of the decree. Indeed, Defendants’ well-earned reputation for threatening behavior and retaliation in violation of the Final Judgment has so permeated the industry that venues are afraid to leave Ticketmaster lest they risk losing Live Nation concerts, hindering effective competition for primary ticketing services.”

The memorandum goes into detail, explaining that these violations occurred “shortly after the decree was entered in 2010 and have recurred throughout its term, with the most recent known violation occurring as late as March 2019.” The memorandum puts forth violations at six venues identified as Venues A through Venue F, all stating they lost or were threatened with losing Live Nation shows for using or considering a non-Ticketmaster ticketing service.

The descriptions indicate at least four of the venues were arenas and one was a stadium. Banc Of California Stadium was identified by Billboard as one of the complainants in a case where AEG owner Phil Anschutz held the ability to veto LAFC ticketing contracts, though the venue eventually signed a contract with Ticketmaster. But the DOJ claimed Ticketmaster’s President (which Billboard reported was Jared Smith at the time) said “Live Nation would never do a show” in the building and would “find other places for their content” if the venue chose a competing ticketing service. Live Nation denies the allegations.

In an April 2018 New York Times article, Louisville, Ky.’s KFC Yum! Center was identified as another complaining venue, though Live Nation told the Times the number of concerts it has booked at Yum! Center has actually increased since 2012, despite the venue reportedly considering a competing ticketing service.

The court documents do not name individuals associated with complaints, but do provide the titles of president of Live Nation arenas, Ticketmaster VP for Client Development, Ticketmaster EVP and Co-Head of Sports for NBA and NHL, and Ticketmaster President.

Despite the accusatory language from the investigation, Live Nation and the DOJ have agreed to modify the terms of the consent decree and extend it for five and a half years. The modified version continues to prohibit threats, conditioning and retaliation, mandates the appointment of an independent monitor to investigate and report on Live Nation’s compliance, adds language defining threats and violations, requires Live Nation to notify venues of the terms of the consent decree, and establishes a $1 million fee for each violation and a $3 million fee to cover the DOJ’s expenses for its investigation.

The hullabaloo about Live Nation’s and Ticketmaster’s synergies is understandable, as ticketing is an integral part of Live Nation’s business. In the company’s last full-year earnings report in 2018, ticketing was clearly the engine powering the growing Live Nation machine.

That year, Live Nation’s overall revenue was up 11 percent for a record total of $10.8 billion over the year, according to its earnings release.

“Ticketmaster continued growing its leadership position in ticketing in 2018,” the promoter’s year-end earnings release stated, “with fee-bearing gross transaction value (GTV) up 14% and total platform GTV of $33 billion.” In its 2018 financial statement, Live Nation’s Adjusted Operating Income, by which it reports its earnings, was listed as $829,144,000, of which ticketing accounted for $436,512,0000 or 52.6% – the majority of its AOI. Touring, with its lower margins, wasn’t even second. Sponsorship and advertising listed at $315,599,000 accounted for 38% of its 2018 AOI while Touring came in third with $225,982,000 AOI or 27.2% of the total AOI.

With ticketing being so important to Live Nation’s bottom line, it seems a no-brainer that the company will frequently choose to route tours through venues that use the Ticketmaster platform, as it simply makes financial sense.

When Live Nation CEO and President Michael Rapino was asked in September about accusations of violating the consent decree that allowed Ticketmaster and Live Nation to merge 10 years ago, he was candid in a quote reported by Variety: “[The consent decree] is very simple: It says we can’t threaten venues. We can’t say to a Ticketmaster venue that says they want to use a different ticketing platform, ‘If you do that, we won’t put shows in your building.’ It also says we can do what’s right for our business, so we have to put the show where we make the most economics, and maybe that venue [that wants to use a different ticketing platform] won’t be the best economic place anymore because we don’t hold the revenue.”

The DOJ claimed the consent decree’s modification was “the most significant enforcement action of an existing antitrust decree by the Department in 20 years.” But it does not appear to affect Live Nation’s ability to “bundle” its promotion and ticketing services.

Jerry Mickelson, co-founder of Jam Productions, told Pollstar the extension of the consent decree ignores an imbalance of power in the live business.

“The DOJ’s settlement with Live Nation does nothing to address the problems which have allowed Live Nation to maintain their monopoly power while increasing their market share across the live entertainment industry. Their utter and complete control of the ticketing contracts at most of the major venues, their ownership of many of the major talent managers through which they control talent, the control of artists’ careers with large cash advances to performers they do not manage, their ability to utilize the secondary market to pay artists, their ‘inside’ deals at the venues and their ownership/leases/management contracts of outdoor amphitheatres, arenas, theatres and clubs has provided them a platform to control and dominate with their predatory practices and monopoly power. There is not an act that Live Nation cannot overpay in order to stop their competitors from competing with them.

“A rival ticketing company [recently told me] they have tried to sign up 40 arenas to provide ticketing services but did not score one contract because every venue is afraid of losing Live Nation content.”

The concern that Live Nation doesn’t need to threaten venues for the environment to be anticompetitive, indeed, has existed since Ticketmaster and Live Nation were initially allowed to merge in 2010.

Still, a touring industry veteran Pollstar spoke with said Ticketmaster is far and away the superior ticketer in the marketplace with technology, analytics and marketing tools few others can match, and the company wins ticketing contracts on the quality of the service offered.

All that said, as Pollstar has chronicled, the live music market over the last decade was booming, with average ticket prices climbing nearly 40% and average gross per show up 87%. Many artists, managers, promoters, agencies, venues, festivals and ticketers across the globe are having their best years ever.

This while today’s consumers have more choice in the marketplace than ever as to how they can engage with live performances – from their local boîte, a free summer lawn series and performing arts centers to sports arenas, mega festivals and stadium shows. The extension of the consent decree, while chronicling numerous alleged violations out of thousands of transactions, may seem like something of a mixed message from the DOJ – but for many in our industry it’s just business as usual.